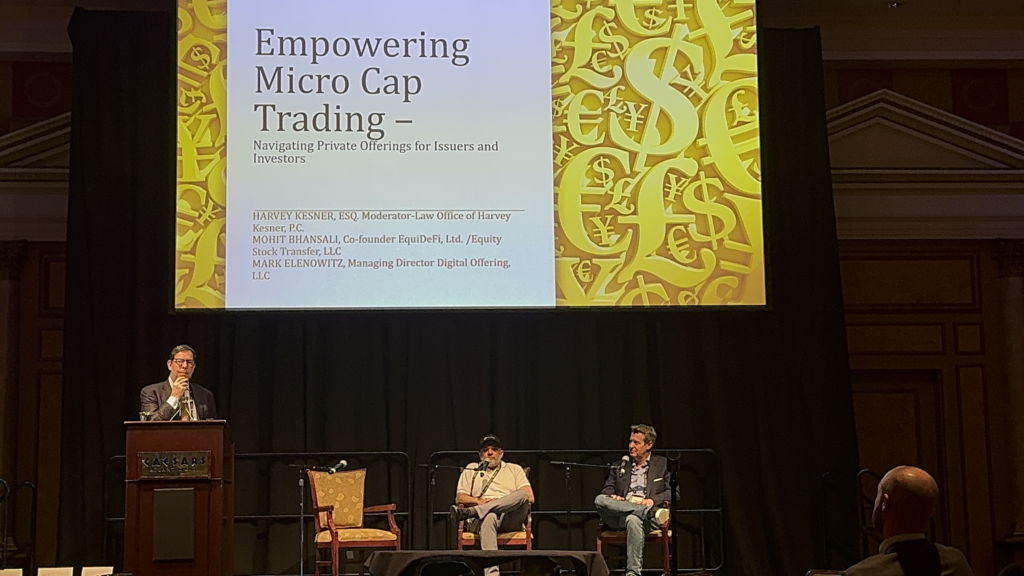

Harvey Kesner, principal attorney of Law Office of Harvey Kesner, recently took the stage at the Microcap Conference to shed light on the intricacies of micro cap trading. The conference, organized by DealFlow Events and hosted at the prestigious Caesars Atlantic City Hotel & Casino over three days, brought together publicly-traded microcap businesses and qualified private companies across diverse sectors like healthcare, technology, financial services, energy, and more.

Key Takeaways:

- Navigating Private Offerings: Kesner’s presentation emphasized the importance of navigating private offerings for both issuers and investors in the micro cap arena. The discussion focused on strategies to efficiently track and close private offerings, enhancing transparency and compliance. This, in turn, creates a conducive environment for businesses to unleash growth opportunities.

- Understanding Micro Cap Dynamics: The presentation delved into the unique characteristics of micro-cap stocks, defined as those with a market cap ranging between $50 million and $300 million. Micro caps, known for their higher volatility, pose inherent risks compared to larger-cap stocks. Limited information availability demands thorough research to avoid potential pitfalls, including fraudulent stocks.

- Accredited Investor Insights: Kesner explored the criteria for accredited investors, essential for participation in private offerings. The definition, as outlined in Section 413(b)(2)(A) of the Dodd-Frank Act, includes individuals with a net worth exceeding $1,000,000 (excluding the value of the primary residence) and those with an income exceeding $200,000 (or joint income exceeding $300,000) in the two most recent years. Additionally, individuals holding professional certifications or designations recognized by the SEC also qualify.

In the rapidly evolving micro cap landscape, Law Office of Harvey Kesner can offer valuable guidance to investors and issuers alike, providing a roadmap for making informed decisions in this dynamic market.